Best drug rehab centers is a collection of addiction treatment centers that professionals should visit. Addiction treatment professionals are consistently seeking new relationships. With the current challenging business landscape, this is a difficult task. This is resources for outreach professionals to meet and establish new relationships. Treatment centers and drug rehabs from Florida to California will be covered.

What Are the Best Drug Rehab Centers?

There are five basic aspects for treatment centers for drug addiction. However, there are different methods and techniques that set some substance abuse treatment centers apart. At the very least you should have an in-depth knowledge of the five basic services. Then you’ll have a better understanding how some are better than others.

- alcohol detox centers

- opiate detoxification centers

- Inpatient drug rehabs

- intensive outpatient

- outpatient

Why the Best Drug Rehab Centers Options are Needed?

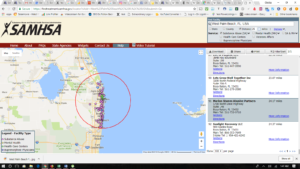

A best drug rehab centers list is needed for many reasons. The heroin epidemic is causing the deaths of over 150 per day. From California to Florida help is greatly needed.

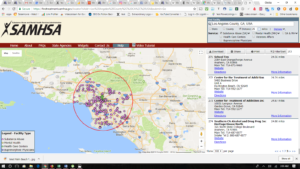

California was one of the top ten states for the rates of drug use in many categories of drug use. These include illicit drug use in the 12 -17 age group. 10.7% of California residents have reported the use of illicit drugs compared to 8.2% nationally. Over 35% of admissions for drug use were for the abuse of stimulant drugs such as heroin and methadone.

More people die from drug abuse that motor vehicle accidents or firearms use. Prescription drug abuse is the fastest-growing drug problem in the US. This combined with the national heroin epidemic makes cause for great concern.

The Best Addiction Treatment Rehabilitation Facilities

Finding the best addiction treatment centers for drug addiction is no easy feat. There are many things that must be considered. These range from the basic types of services to specialized services. Some of the basic services include;

- alcohol detox centers

- opiate detoxification

- inpatient

- residential PHP

- intensive outpatient or IOP

- outpatient or OP

- sober homes

Best Drug Rehab Centers Need to Treat You’re Specific Needs

Here is what we learned from the best drug rehabs West Palm Beach websites. When seeking the best drug rehab centers you need to make sure they can help with your specific needs. Drug and alcohol addiction treatment is different for everyone. Each individual has their own needs that need to be addressed. Some of the factors that affect this could be;

- type of drug misused

- length of drug use

- trauma like physical or mental

- anxiety issues

- bi-polar disorder

- PTSD or post traumatic stress the disorder

These are just a few of the co-occurring disorders that are common with drug and alcohol abuse. When speaking with a substance abuse rehabilitation centers it is important that these be addressed in the initial phone call. If they are not, you may want to consider a difference center if you want the best care for your individual needs.

Florida Drug Rehabs Role

Florida drug rehabs especially West Palm Beach have molded California addiction treatment centers. Florida was the first state to institute new laws governing substance abuse treatment centers. These regulations were put in place to regulate the industry.

The main area the new laws focus on is drug rehab marketing. Understanding these new regulation requires a specialist in addiction treatment center advertising. Rehabilitation centers must follow these when they are marketing. The new laws are now spreading across the United States. They have caused problems for many operators. This is because they traditionally used pay per click as their lead generation. With the regulations the best drug rehab centers are now required to have Legit Script certification to do any PPC on google and Facebook.

The small to medium size addiction treatment centers can’t afford this. They are competing against companies spending over $500,000 per month in pay per click. This is forcing them to perform drug rehab SEO for their lead generation. It’s a blessing in disguise because the cost per acquisition is lower over the long run with search engine optimization. This also helps individuals find the best drug rehabs Los Angeles to Florida.

Best Michigan Drug Rehabs Options

When seeking the best drug rehab centers be wary of the paid ads on Google. While only 2% click on the paid ads, it’s still worth mentioning. The best drug rehab centers will be on page one in two areas which are the maps section on organically under the maps. The information here is not designed for a sales pitch, it generally provides excellent information on the process of drug and alcohol addiction treatment.

There are many drug rehabs Fort Lauderdale Options. The Source drug rehabs Fort Lauderdale is located in Broward County. They are one of the best choices because of their unique care and the passion of their staff. Their main substance abuse rehabilitation services include;

- (PHP) Residential Inpatient drug rehabs Fort Lauderdale Program

- (IOP) intensive Outpatient

- Outpatient

- Stabilization

While opiate and alcohol detox is not on the list of their main services, they do worked several well vetted detoxification providers in the Fort Lauderdale and West Palm Beach areas. When trying to find drug rehabs near me in Fort Lauderdale, they are the best choice.

What Are the Best Drug Rehabs Providing for Services?

Alcohol detox centers San Diego addiction treatment centers should be educating their audience with useful content. Many drug and alcohol addiction treatment centers do this very poorly. Read you blog. Are the posts at least 1,500 words long. Another question is, “Does the blog post rank on page one of Google for a popular search time. If you answered no to either of these questions, you are wasting money on marketing. not only for the service, but also for not ranking on Google that gets 40,000 searches every second. amount of experience college students. However, they are specialized for anyone over 18 years of age.

They focus on six main areas and have seen tremendous results due to their high level of behavioral healthcare. This is no surprise since they are Joint commission accredited. This Gold sear as it’s referred to in the industry, says they are upheld to the same high standards as hospitals. Their top 6 drug and alcohol addiction treatment areas are;

- alcohol detox

- opiate detox

- inpatient

- intensive outpatient

- sober homes

- co-occurring disorders

One of the biggest reasons they rank so well is because of their national known work with co-occurring disorder. These often are at the core of the addiction issues left untreated drastically increase the chances of a relapse.

What Makes the Best Drug Rehabs San Diego?

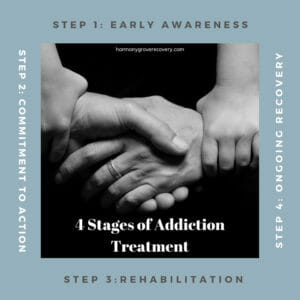

What makes the best drug rehabs San Diego, California may be holistic treatment offerings. When treating depression, PTSD or any behavioral health issues you have to treat the whole person. this is where many addiction treatment centers fail. The physical and the spiritual must be treated. They utilize credentialed substance abuse counselors to address the physical aspects. There are four principles which include;

- The healing power comes from within you.

- Addiction is only a symptom and the whole person needs to be treated.

- Long-term recovery is achieved by honesty and action with the physician, substance abuse counselor and many personal relationships.

- Our drug rehabs Austin Taxes centers staff treats the core of drug and alcohol addiction.

Best Drug Rehabs Fort Lauderdale Options

The best drug rehabs Fort Lauderdale provide for residential inpatient and intensive outpatient services. This is a Joint Commission accredited substance abuse rehabilitation facility. The service south Florida including Miami, Fort Lauderdale, West Palm Beach, Stuart and Port St Lucie Florida. Their services include

- residential inpatient day/night PHP

- intensive outpatient program (IOP drug rehabs)

- medication assisted treatment (MAT Program)

- outpatient

- individual substance abuse counseling by credentialed counselors

- family program

- mental health

- brain mapping

- biofeedback therapy

- EDMR

What Are the Best Women’s Sober Homes West Palm Beach FARR Certified Residences?

When seeking the best drug rehab centers in West Palm Beach, Florida options be careful. Many are tied into sober homes. You want to be sure to deal with a FARR certified recovery residence. There are many half-way house in West Palm and Palm Beach Gardens. By Picking a FARR residence you can be sure you will get the best care.

One of the best women’s sober homes in West Palm Beach is Edna’s Sober House. They are 12 step based and even take pregnant women. In the setting you will be with other women who are going through the same things you are. This is critical as sometimes women’s participation is a sober home is limited if there is a cross population. Edna’s has helped many women to long-term recovery.

Best Drug Rehab Centers in California

The best California drug rehab centers in San Diego is Lilac Recovery’s substance abuse treatment center in

San Diego. It goes beyond drug rehabilitation. Their specific motivation is to help those in a community setting who may have a problem with addictive drugs or other mental disorders. At each phase of treatment, clients receive certain levels of care. Then there is a proven gradual step-down process. This is most effective for recovering adults in this critical phase of their lives.

California Rehabilitation Programs

When seeking the top 10 California drug rehabs there are several things to consider. During the initial phase of our substance abuse program in New Brunswick, New Jersey, we teach our clients how to become characters of action. We focus on undertaking many simple daily tasks such as cleanliness, personal hygiene, and physical health. The best drug rehab centers will carefully guides you along with proven treatment programs. Our team of case managers assists every step of the way providing the needed planning, communication and guidance. This helps take care of any outstanding issues outside the drug rehabilitation program that stands in the way of their recovery process.

Get the Drug and Alcohol Addiction Recovery Help You Need

At the best Michigan drug rehab centers everyone needs to demonstrate the values necessary to move onto the next phase of treatment. They are simultaneously given more responsibility for themselves and less restriction on their time. On this phase of treatment, clients will begin to re-enter society and school. At this point, clients begin to attain and build confidence and future goals. All the while still actively practicing the principles from the previous phase of addiction treatment.

This gives every individual a defined incentive to take advantage of new opportunities for work and education. It is in this phase that case managers begin to assist clients in three critical areas.

- resume construction

- job interview training

- educational enrollment assistance

These milestone areas are for those looking to move forward toward stability and financial independence.

Drug rehab is a Life-Long Journey

The best drug rehabs San Diego prepare you to deal with this life long disease. Addiction recovery must always be top of mind for many individuals. After successfully completing the first two phases of treatment, clients are then stepped down to the lowest level of treatment. Here, clients have minimal daily requirements and become even more self-sufficient. Many of our clients pursue both education and employment simultaneously. However, everyone is given the best resources to help them follow their path toward future success, one day at a time.

Individuals also begin to start developing relationships outside of our addiction recovery program. Many participate in 12 step meetings, taking active roles in the recovery community. They begin to define themselves as leaders of their peer group.

Many Goals of Drug Treatment

The best drug rehab centers prepares you for the transition back into mainstream society. This is where your life goals can once again be obtained. We guide you in the process with our transitional living program. This program will also provide you with the tools needed to sustain freedom from addiction. Our phase III program includes;

- Clinical Therapy

- Case Management

- Educational Planning

- Family Support Program

Why Some California Facilities are the Best Drug Rehab Centers?

California drug rehabs San Diego have been battling addiction for years. Between 2005 and 2009 over 50% of Californians aged 12 and older had consumed alcohol in a 30 day period. Binge drinking and alcohol abuse are on the rise in California. In the years between 2009 and 2013 2.3 million residents of California battled alcohol use and dependency, an average of 7.5 of the population above 12 years of age. Alcohol abuse is thought to have cost the state $32 billion a year.

Lawmakers have instituted new drug rehab SEO marketing and business laws to protect those seeking substance abuse treatment. These have been made to protect the vulnerable from patient brokering. Rehabilitation centers are now required to have Legit Script certification to run paid ads on Google. They also have to clearly state they are a verified treatment center with the physical address listed on their website.

The information provided on the best drug rehab centers in Los Angeles provides is a good starting point when seeking addiction treatment centers. Searching for the best medical fit is important and understanding the drug rehab marketing laws and the agencies that provide the advertising provides the tools to find the correct medical fit for drug rehabilitation.

Best Drug Rehabs San Diego, California Provides

One of the best drug rehab centers in San Diego, California is Harmony Grove Recovery. They are a inpatient, residential, intensive outpatient rehabilitation center that also offer detox services. This is a luxury addiction treatment centers with incredible living areas.

It can sometimes be difficult to know when someone you love needs treatment for alcoholism or drug addiction. However, the National Institutes of Health has provided guidelines to help. These guidelines will allow you to figure out when your loved one is abusing drugs or is addicted to drugs.

Determining the Need for the Best Drug Rehabs San Diego Centers for Addiction Treatment

While you may notice your loved one is using drugs or alcohol, he or she isn’t doing it every day. They may drink or do drugs on the weekend, but not during the week. Your family could also be struggling with addiction if your loved one cannot stop using their drug of choice. They may want to stop, but, for some reason, cannot.

Another sign would be if your family member tries to stop using and, then, gets sick. This signals that he or she is going through withdrawal. Withdrawal symptoms indicate a dependence on a drug. You should also know addiction is a disease. It alters someone’s brain chemistry for life. The medical community has characterized it as a chronic illness.

You now know your loved one needs treatment. But what kind of rehab programs in Southern California would be best for your family? what are the best drug rehab centers? Here are resources foe drug rehabs San Diego, California addiction treatment programs.

Alcohol and Opiate Detox Centers San Diego, California

One opiate and alcohol detox treatment center in San Diego, California stands out from the rest. When you first enter the drug rehab San Diego, center for a tour you are amazed by the luxurious facilities. During the tour you are equally amazed at the qualified staff. The doctors are highly experienced in addiction treatment. While the credentialed counselors demonstrate a passion for assisting in long-term recovery.

As professionals we know before any addict can begin treatment, they need to undergo detoxification. At the best drug rehab centers in San Diego the patient receives support as his or her body goes through withdrawal. Nearly all addicts need medical help to detox from drugs or alcohol. This is because there are symptoms from drug withdrawal that can be mild (nausea) or severe (arrhythmia). This opiate detox center in San Diego, California is focused on marketing the detoxification process as painless as possible. They provide detox programs as a part of either inpatient or outpatient rehab programs.

Best Drug Rehab Centers in San Diego, California for Residential Inpatient

Luxury residential inpatient drug rehabs San Diego, California options are plentiful. After all California is home to many wealthy individuals. Long-term rehabilitation programs usually house clients from six months to one year. This is a big commitment so you better make sure it’s the right fit for individual needs.

Usually, the best drug and alcohol detox treatment centers in San Diego are modeled around therapeutic communities. These communities begin on the assumption that addiction is a chronic disease. Also, the assumption is that just as a chronic disease has flare-ups, addicts can have relapses. The goal is for sobriety in the long-term and management of the addiction. The end result is your client can remain on the path to sobriety. Therapeutic communities in residential rehabilitation centers focus on the health and wellness of the patient. They tailor their intensive therapies and treatments toward changing the client’s behavior.

These substance abuse treatment programs from the best drug rehab centers teach stress reduction techniques. Addicts are encouraged to develop sober networks of friends within the community. Also, they work on the personal hygiene of the patient and reintegration into the community. This addiction treatment centers focuses on education, and employment. The ultimate goal of the long-term rehabilitation center is to prepare clients to move onto progressively less structured programs. Eventually, the client will move to an outpatient facility, sober living house, or community therapy.

Best Drug Rehab Centers in San Diego, California

Intensive outpatient drug rehabs San Diego, California have become very popular. There is a trend across the nation for this addiction treatment modality. It’s most likely driven by the insurance companies pay less for out of network benefits. However, these programs are not for every person who is struggling with addiction. Your clients may just be moving from abuse to addiction. They may have a mild addiction problem, but he or she realizes they need help.

Your clients may benefit from an outpatient rehab program. They’re designed for people who want to stop drinking or using drugs. These programs allow patients to continue working and going to school. If they’ve a mild addiction and don’t need to detox, the intensive outpatient drug rehabs, San Diego, California therapy might be a way they can begin treatment.

Best Drug Rehab Centers Los Angeles Addiction Treatment Options

Best drug rehab centers in Los Angeles providing intensive outpatient, IOP, opiate detox, alcohol detox, and medication-assisted treatment near Van Nuys, California. Drug and alcohol addiction treatment centers near me in the LA area for substance abuse rehabilitation. Better results and Suboxone clinics and Doctors with our proven MAT program.

The best Drug rehabs Los Angeles provides includes intensive outpatient addiction treatment centers, opiate detox, medication-assisted treatment (Suboxone clinics) and alcohol detox centers. The reason is LA was one of the top ten states for the rates of drug use in many categories of drug use. These include illicit drug use in the 12 -17 age group.

– 10.7% of California residents have reported the use of illicit drugs compared to 8.2% nationally.

– Over 35% of admissions for drug use were for the abuse of stimulant drugs such as heroin and methadone.

– More people die from drug abuse that motor vehicle accidents or firearms use.

– Prescription drug abuse is the fastest-growing drug problem in the US.

What to Look for When Seeking the Best Drug Rehab Centers Los Angeles Options?

This information helps to find the best outpatient IOP drug rehabs. However, it’s only a starting point. It provides various information on what to look for in a substance abuse treatment center. Addiction is darkness, and many feel lost. The right medical care can bring your life back.

You want to look for the best drug rehab centers in the Atlanta, Georgia area that apply evidenced-based 12 step treatments. Many also need medication assisted treatment Los Angeles Suboxone clinics (MAT) guided by qualified physicians and doctors. Be careful with the use of Suboxone clinics programs, services, and tools you need to reach sobriety. There are four main options to consider that include:

• Outpatient Detox

• Intensive Outpatient drug rehabs

• Residential Inpatient Drug Rehab Program

• Sober Homes

Look for specifics on opiate, alcohol, and prescription drug addiction treatment. Be sure to research several different centers. The are many laws pertaining to addiction treatment providers on how they can obtain clients. These national laws started with Florida drug rehabs West Palm Beach. You may also consider on-site visits and evaluating their staff. You want master level clinicians providing the medical care.

Why the Best Drug Rehab Centers Are Needed in Los Angeles?

California drug rehabs Los Angeles is one of the biggest areas in the US to find the best drug rehab centers. It’s also notorious for alcohol and drug addiction. Between 2005 and 2009 over 50% of Californians aged 12 and older had consumed alcohol in a 30 day period. Binge drinking and alcohol abuse are on the rise in California.

In the years between 2009 and 2013 2.3 million residents of California battled alcohol use and dependency, an average of 7.5 of the population above 12 years of age. Alcohol abuse is thought to have cost the state $32 billion a year.

When seeking the best drug rehabs La Jolla centers or in any area research is key. Addiction treatment is one of the most important decisions of your life. Substance abuse is uniquely specific to each individual. You must make sure the rehabilitation center you pick is equipped to treat your specific requirements. However, there are new drug rehab SEO marketing that are now in place that treatment centers must obey.

Where are the Best IOP Drug Rehabs Austin Texas Addiction Treatment Centers?

The best IOP drug rehabs Austin Texas offers is an intensive outpatient program. This IOP drug rehab is the most popular in the Austin area. As a matter of fact, they are one of the best Texas drug rehabs. There intensive outpatient drug and alcohol addiction treatment centers provide rehabilitation services for drugs and alcohol. They also have resources for alcohol detox centers in the Austin area.

With a few of the best drug rehab centers holistic treatments play a big role in our rehabilitation program. It is not just about addiction but the underlying issues that are at the core of the addiction. We help bring these to the service by various therapies. some of these may include the following.

- nutritional therapy

- art therapy

- exercise therapy

- music therapy

Best Drug Rehab Centers Addiction Treatment Alternatives

There are drug detox and drug rehab alternatives to addiction treatment and a few of the best drug rehab centers are providing them. Medication assisted treatment is on the rise. Harm reduction is saving many lives. There are many substance abuse rehabilitation centers providing this service. In addiction, there are many providing IOP or intensive outpatient care. This is being controlled by the insurance companies. It is a difficult situation for residential inpatient care, as the insurance companies are more reluctant to pay for long-term care.

Alternatives like amino acid therapy are making strides. However, these are not for every one. You need to be professionally evaluated and given a customized treatment plan. Drug and alcohol addiction treatment is not the same for everyone.

Learn More About Drug Rehabs by Attending our Addiction Conferences

Our EMP series Addiction conferences educate Executives, CEO’s and Directors on ethical drug rehab marketing and business practices. These behavioral health events focus on how small to medium size centers can fill their beds. Many centers are trying to use Google Ad Words with Legit Script certification. This is a costly mistake. Learn more at this anticipated sequel California addiction conferences event.

Best Opiate Drug and Alcohol Detox Centers Port St Lucie, Florida

The best drug detox centers in Port St Lucie can be found here. This one is part of the AGAPE Treatment Center family. This mother center is in Fort Lauderdale, Florida. It services West Palm Beach, Stuart and all of south Florida. This is one of the best because they focus on the mental health side. This is great news since most addiction has co-occurring disorders and requires dual diagnosis.

Addiction professionals should take the time to tour this center and get to know them. The treatment center is Joint commission accredited. The opiate drug detox centers in Port St Lucie accepts the following heath insurance policies.

- AETNA heath insurance

- Anthem BCBS

- Horizon BCBS

- CIGNA health insurance

- UMR health insurance

How to Find the Best Drug Rehab Centers Article Recap

This article on the best drug rehab centers addiction professionals should visit provides valuable information. When seeking drug and alcohol addiction treatment centers it can be overwhelming. Understanding the patient brokering laws is complicated enough. However, there is so much more that has to be evaluated.

Trying to determine which type of rehabilitation center is right for any individual is complicated. There are many good addiction treatment centers in San Diego, Los Angeles, New Jersey and Florida. Evaluating the different levels of care include;

- alcohol detox centers

- opiate detox

- inpatient drug rehabs

- intensive outpatient care

- sober homes

Also remember there are addiction treatment alternatives that may be right for you. Use this best drug rehab centers for addiction professionals list. Call these behavioral health centers when you start your search. Remember to reach out to at least three before making any determination. Below are the best addiction treatment social media groups that may also be of assistance.

Join the best 60 Addiction Professional Social Media Groups with 210,000 members for Information on Drug and Alcohol Addiction Treatment.

Get on our radar by following us on social media…

California drug rehabs Los Angeles and drug rehabilitation centers across the US have been operating unethically for many years. The heroin epidemic has exposed many fraudulent practices in this 40 billion dollar a year industry. Lawmakers are making their way across the nation with patient brokering laws to save lives and protect the vulnerable. The new laws in California are going to directly affect the ability to operate in the state if they are operating unethically. To survive the difficult changes in behavioral healthcare, centers need to adopt a healthy business and marketing mix.

California drug rehabs Los Angeles and drug rehabilitation centers across the US have been operating unethically for many years. The heroin epidemic has exposed many fraudulent practices in this 40 billion dollar a year industry. Lawmakers are making their way across the nation with patient brokering laws to save lives and protect the vulnerable. The new laws in California are going to directly affect the ability to operate in the state if they are operating unethically. To survive the difficult changes in behavioral healthcare, centers need to adopt a healthy business and marketing mix.

California drug rehabs Los Angeles locations are being forced ethical drug rehab marketing. Drug rehabs San Diego and Los Angeles are learning about digital Darwinism because of the new regulations. Outdated buy rehab leads strategies no longer work and some are illegal in 2020. Senator Ricardo Lara (D-Bell Gardens) signed the

California drug rehabs Los Angeles locations are being forced ethical drug rehab marketing. Drug rehabs San Diego and Los Angeles are learning about digital Darwinism because of the new regulations. Outdated buy rehab leads strategies no longer work and some are illegal in 2020. Senator Ricardo Lara (D-Bell Gardens) signed the  California drug rehabs Los angeles must understand Florida was the first state to focus on patient brokering laws for residential, inpatient and outpatient drug rehabilitation centers in the substance abuse industry. They have set the pace for the nation, but it has affected some ethical operators that did not change their business and marketing strategy. The media was quick to jump on the bandwagon providing, for the most part, unethical journalism.

California drug rehabs Los angeles must understand Florida was the first state to focus on patient brokering laws for residential, inpatient and outpatient drug rehabilitation centers in the substance abuse industry. They have set the pace for the nation, but it has affected some ethical operators that did not change their business and marketing strategy. The media was quick to jump on the bandwagon providing, for the most part, unethical journalism.

The signs have been evident for a substantial time period, but the problem has been and will continue to grow more severe as time continues. The main pain points of drug rehabs are marketing and billing. These are the two hands that are feeding any addiction treatment center.

The signs have been evident for a substantial time period, but the problem has been and will continue to grow more severe as time continues. The main pain points of drug rehabs are marketing and billing. These are the two hands that are feeding any addiction treatment center. One area which evidences this trend in the insurance industry. It is the growing direction for providers to attempt to change from out of network to full in-network providers. Most facilities these days are desperately becoming only in-network providers even though the amount per day paid by the carriers for in-network benefits has steadily been falling.

One area which evidences this trend in the insurance industry. It is the growing direction for providers to attempt to change from out of network to full in-network providers. Most facilities these days are desperately becoming only in-network providers even though the amount per day paid by the carriers for in-network benefits has steadily been falling. Obviously, this was and continues to damage the providers financially. They are rendering services in good faith but never receiving the checks from the carriers. The reality is that many providers did not even realize that their check-in reimbursement for services rendered had not even been sent to them by the carrier. Some of the providers are losing exorbitant amounts of money in this fashion. Many do not realize this when it is happening.

Obviously, this was and continues to damage the providers financially. They are rendering services in good faith but never receiving the checks from the carriers. The reality is that many providers did not even realize that their check-in reimbursement for services rendered had not even been sent to them by the carrier. Some of the providers are losing exorbitant amounts of money in this fashion. Many do not realize this when it is happening. However, at the same time that are certain methods which at almost no cost can result in the infusion of additional capital into a sagging P/L statement.

However, at the same time that are certain methods which at almost no cost can result in the infusion of additional capital into a sagging P/L statement.  The return on investment to employ debt collection methods is so low as to beg for utilization. The process is very simple for drug rehabs, but at the same time there are Federal and State regulations which must be complied with and of course, the privacy of the patient/debtor needs to be protected. This can all be accomplished by utilization of the proper documentation.

The return on investment to employ debt collection methods is so low as to beg for utilization. The process is very simple for drug rehabs, but at the same time there are Federal and State regulations which must be complied with and of course, the privacy of the patient/debtor needs to be protected. This can all be accomplished by utilization of the proper documentation.

Not having sufficient operating cash is a common problem for many rehabilitation centers. This is due to poor substance abuse billing. Some rely on billing companies and trust they are doing a good job. Some do their own in-house billing. Either way, in-depth knowledge is an absolute must to get paid quickly. So, what are the common mistakes made by addiction treatment centers? Knowing the

Not having sufficient operating cash is a common problem for many rehabilitation centers. This is due to poor substance abuse billing. Some rely on billing companies and trust they are doing a good job. Some do their own in-house billing. Either way, in-depth knowledge is an absolute must to get paid quickly. So, what are the common mistakes made by addiction treatment centers? Knowing the

Insurance companies are bullying substance abuse and mental health providers. They are denying substance abuse billing claims, delaying reimbursements, questioning the medical necessity and auditing these organizations. These tactics cause severe problems for providers. The insurance companies for the treatment of behavioral health care issues are using these strategies mainly due to the Affordable Care Act. It has made health insurance available to many by providing subsidies towards the cost of health care for many individuals. It requires insurance plans to cover preexisting health conditions and much needed mental health and

Insurance companies are bullying substance abuse and mental health providers. They are denying substance abuse billing claims, delaying reimbursements, questioning the medical necessity and auditing these organizations. These tactics cause severe problems for providers. The insurance companies for the treatment of behavioral health care issues are using these strategies mainly due to the Affordable Care Act. It has made health insurance available to many by providing subsidies towards the cost of health care for many individuals. It requires insurance plans to cover preexisting health conditions and much needed mental health and

Substance abuse billing providers have to remember that issuing checks directly to the patient serves an important benefit for the insurance carrier. Mainly due to this entire process might become a pressure point for more providers to join the carriers’ network. This eliminates the risk of not receiving reimbursement checks. Paying patients directly provides an important impetus for nonparticipating OON providers to join the network.

Substance abuse billing providers have to remember that issuing checks directly to the patient serves an important benefit for the insurance carrier. Mainly due to this entire process might become a pressure point for more providers to join the carriers’ network. This eliminates the risk of not receiving reimbursement checks. Paying patients directly provides an important impetus for nonparticipating OON providers to join the network. There are many areas of substance abuse billing that behavioral health organizations overlook. Getting paid quickly is paramount for many providers. This is one of the main reasons we are seeing recovery centers close their doors.

There are many areas of substance abuse billing that behavioral health organizations overlook. Getting paid quickly is paramount for many providers. This is one of the main reasons we are seeing recovery centers close their doors.

The opiate and heroin epidemic has been fueled by over prescribing opiates by Doctors and pain clinics. Many don’t know how to stop using heroin or prescribe medications. The opiate detox West Palm Beach solution could help many. The Food and Drug Administration (FDA) approved the bridge device, a technology that gets an individual through one stage of recovery.

The opiate and heroin epidemic has been fueled by over prescribing opiates by Doctors and pain clinics. Many don’t know how to stop using heroin or prescribe medications. The opiate detox West Palm Beach solution could help many. The Food and Drug Administration (FDA) approved the bridge device, a technology that gets an individual through one stage of recovery.

You can only get the Bridge Device NSS-2 by prescription from a qualified physician, drug, and alcohol addiction treatment center, or opiate detox center. Other resources provide MAT medication assisted treatment during detoxification. One provider is located in California. You can learn more about them at

You can only get the Bridge Device NSS-2 by prescription from a qualified physician, drug, and alcohol addiction treatment center, or opiate detox center. Other resources provide MAT medication assisted treatment during detoxification. One provider is located in California. You can learn more about them at